Enfield local demand to sustain Eicher valuations

Royal Enfield's (RE) expanding local footprint should help the iconic bike-maker run its plant at full capacity in the next two fiscals, allaying investor concerns over moderating volumes.

The waiting period for the R Classic-350, which accounts for about two-thirds of the company's sales volumes, has come down to two months, and it is about a month for the rest of the models. To some investors in Eicher, the parent of RE, the reduction in the waiting period fore tells moderating volume growth and the need to trim valuations.

The argument in favour of lower Price-Earnings (PE) is not tenable, however, as the reduction is waiting period is attributed to capacity addition. Thus, the growth in orders has greater relevance is assigning the Eicher stock an appropriate valuation range.

At 15 per cent YoY based on Same Store Growth (SSG), orders are expanding faster the increase in capacity. RE has not faced demand disruption from demonetization and the GST transition, and is one of a handful of companies that did not need to pay any compensation to dealers for the GST transition loss.

The company will have an installed capacity to manufacture 825,000 units in the current fiscal and a maximum of 960,000 in the next year. RE has maintained its production target guidance of 825,000 units for FY18.

The Street is pricing in the volume of 825,000 and 950,000 units for FY18 and FY19, respectively,implying volume growth of 23 per cent and 15 per cent, YoY. The rate of volume growth indicates that RE would continue to run at full capacity.

The order inflow will be supported by the expansion of its dealer network. The company had 700 dealers at the end of June 2017 and planned to add another 150 dealers in the next two years.

A sizeable incremental growth is expected from beyond top-20 cities where the company is gradually expanding. Currently,top-20 cities account for nearly 45 per cent of the company's bike sales.

The differentiated positioning of its bikes has built a protective moat for RE. The alliance of Bajaj with Triumph motorcycle could pose a threat to the company,but any product from the alliance could be about three years away.

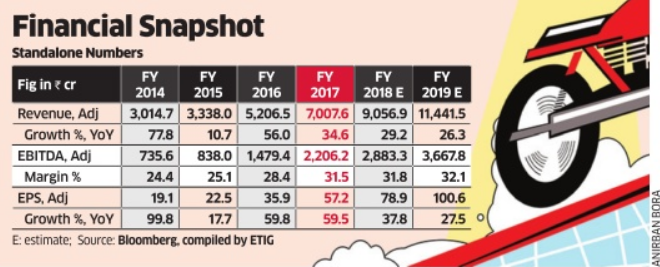

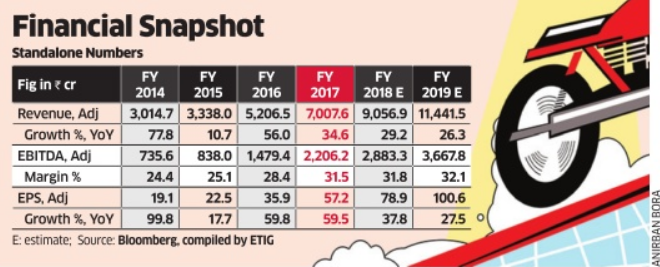

The stock is trading at 31 times its projected next year earnings, a premium of 22 per cent from its long-term average. The RE premium is likely to sustain because of strong volumes visibility,robust earnings growth (around 30 per cent annualized until FY19), little competitive threat and additional exports.

The waiting period for the R Classic-350, which accounts for about two-thirds of the company's sales volumes, has come down to two months, and it is about a month for the rest of the models. To some investors in Eicher, the parent of RE, the reduction in the waiting period fore tells moderating volume growth and the need to trim valuations.

The argument in favour of lower Price-Earnings (PE) is not tenable, however, as the reduction is waiting period is attributed to capacity addition. Thus, the growth in orders has greater relevance is assigning the Eicher stock an appropriate valuation range.

At 15 per cent YoY based on Same Store Growth (SSG), orders are expanding faster the increase in capacity. RE has not faced demand disruption from demonetization and the GST transition, and is one of a handful of companies that did not need to pay any compensation to dealers for the GST transition loss.

The company will have an installed capacity to manufacture 825,000 units in the current fiscal and a maximum of 960,000 in the next year. RE has maintained its production target guidance of 825,000 units for FY18.

The Street is pricing in the volume of 825,000 and 950,000 units for FY18 and FY19, respectively,implying volume growth of 23 per cent and 15 per cent, YoY. The rate of volume growth indicates that RE would continue to run at full capacity.

The order inflow will be supported by the expansion of its dealer network. The company had 700 dealers at the end of June 2017 and planned to add another 150 dealers in the next two years.

A sizeable incremental growth is expected from beyond top-20 cities where the company is gradually expanding. Currently,top-20 cities account for nearly 45 per cent of the company's bike sales.

The differentiated positioning of its bikes has built a protective moat for RE. The alliance of Bajaj with Triumph motorcycle could pose a threat to the company,but any product from the alliance could be about three years away.

The stock is trading at 31 times its projected next year earnings, a premium of 22 per cent from its long-term average. The RE premium is likely to sustain because of strong volumes visibility,robust earnings growth (around 30 per cent annualized until FY19), little competitive threat and additional exports.

No comments